Taxes

2025 Clark County school property taxes

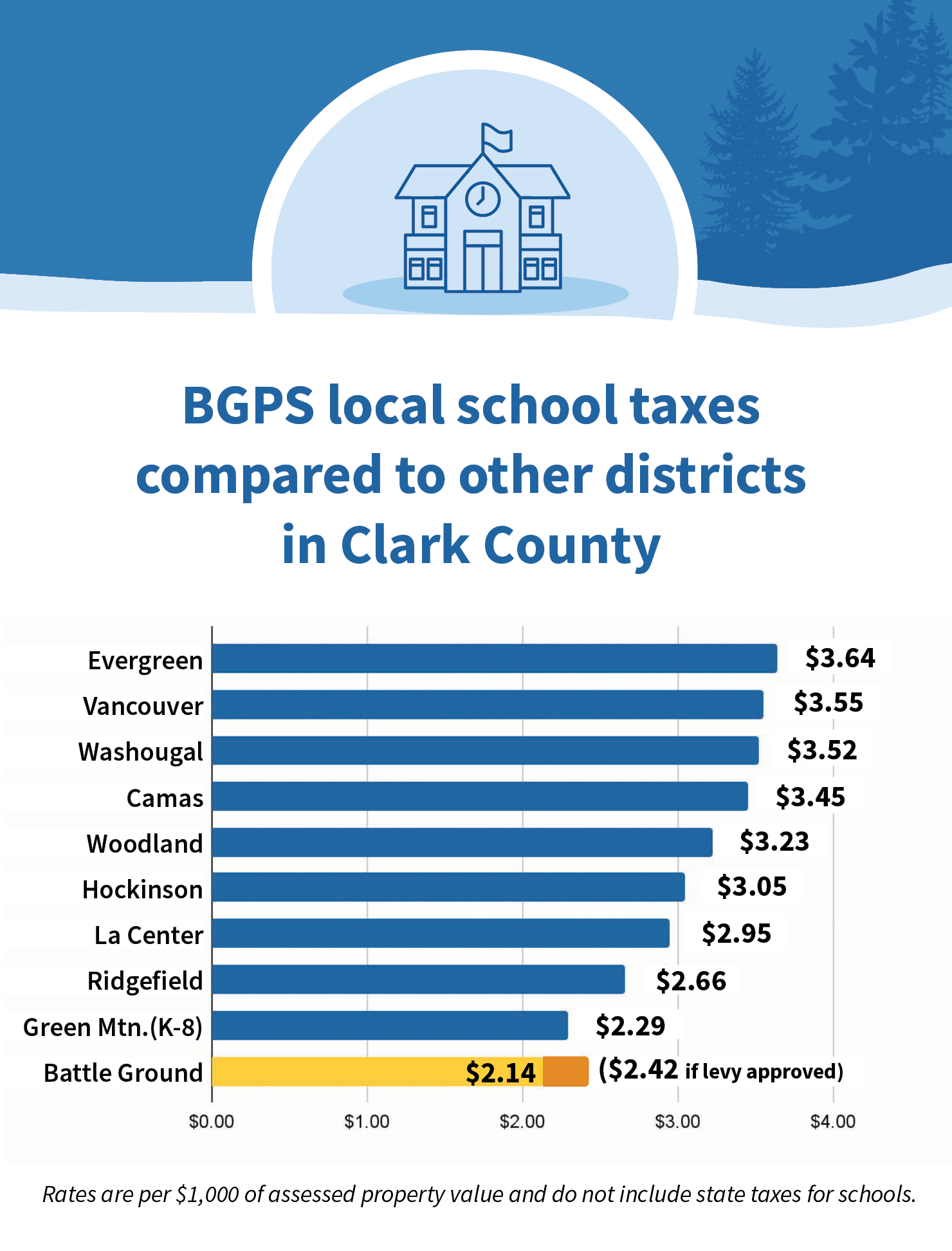

School district | Education and operations levy | Technology levy | Bond | Capital levy | Total local bond & levy* |

|---|---|---|---|---|---|

Evergreen Public Schools | $1.62 | $0.42 | $1.60 | N/A | $3.64 |

Vancouver Public Schools | $2.10 | $0.30 | $1.15 | N/A | $3.55 |

Washougal School District | $1.85 | N/A | $0.86 | $0.81 | $3.52 |

Camas School District | $1.86 | $0.40 | $1.19 | N/A | $3.45 |

Woodland Public Schools | $2.15 | N/A | $1.08 | N/A | $3.23 |

Hockinson School District | $1.68 | N/A | $1.37 | N/A | $3.05 |

La Center School District | $1.33 | N/A | $1.62 | N/A | $2.95 |

Ridgefield Public Schools | $1.57 | N/A | $1.09 | N/A | $2.66 |

Green Mountain K-8 School District** | $2.29 | N/A | N/A | N/A | $2.29 |

Battle Ground Public Schools | $1.69 | N/A | N/A | $0.45 | $2.14 |

Source: Clark County assessor's office

*These rates do not include the state schools property tax rate ($2.43 per $1,000 of assessed property value in 2025).

**Green Mountain serves K-8 students only.

Local funding: Levies and bonds

Battle Ground Public Schools is grateful to local voters and the community for supporting our schools. Your contributions allow us to connect every student to a positive future, employ local workers and construct and maintain buildings that serve the community.

In general levies are for learning (curricula, security and safety, activities, student support services, school improvements) and bonds are for buildings (new construction and replacement schools).

Local voters have approved two kinds of levies that affect property owners’ tax bills:

Educational programs, maintenance and operations levy (approved in 2021 for four years: 2022-2025)

Capital levy (approved in 2024 for three years: 2025-2027)

History of Battle Ground Public Schools property tax rates

2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|---|

BGPS education and operations levy rate | $4.13 | $3.82 | $3.65 | $3.31 | $3.45 | $1.50 |

BGPS capital levy rate | N/A | N/A | N/A | N/A | N/A | N/A |

BGPS bond rate | $0.85 | $0.86 | $0.81 | $0.73 | $0.67 | $0.61 |

State schools levy rate | $2.35 | $2.24 | $2.07 | $1.98 | $2.89 | $2.51 |

Combined state and local tax rates | $7.33 | $6.92 | $6.53 | $6.02 | $7.01 | $4.62 |

2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|---|

BGPS education and operations levy rate | $2.50 | $2.32 | $1.97 | $1.70 | $1.65 | $1.69 |

BGPS capital levy rate | N/A | N/A | N/A | N/A | N/A | $0.45 |

BGPS bond rate | $0.58 | $0.56 | $0.52 | $0.43 | N/A | N/A |

State schools levy rate | $2.85 | $2.94 | $2.73 | $2.33 | $2.25 | $2.43 |

Combined state and local tax rates | $5.93 | $5.82 | $5.22 | $4.46 | $3.90 | $4.57 |

Rates are per $1,000 of assessed value. Taxes are collected on a calendar year.

Sample tax amounts

To calculate the amount that you’ll owe annually in school taxes, please use the following formula:

Assessed home value ÷ 1,000 x levy and/or bond rate

Assessed home values (which vary from market values) are determined by the Clark County Assessor’s Office.

Your home’s assessed value affects your overall tax bill.